A just-published report updated our multi-asset recommendations and investment strategy. Investors have been upbeat about the outlook, betting that:

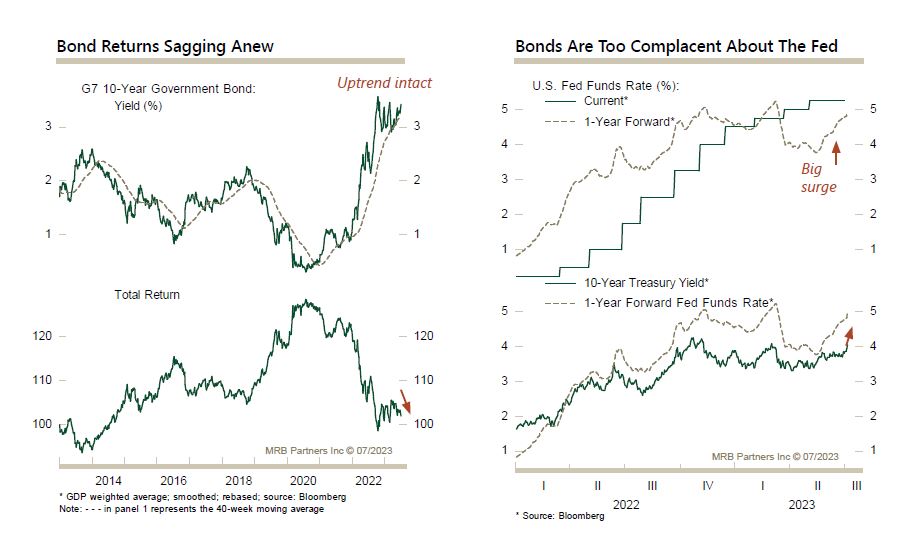

- The Fed and other central banks will be able to cut rates meaningfully in the year ahead.

- Core inflation will decelerate close to the 2% area.

- And the global economic expansion will be sustained.

We doubt that this trifecta of outcomes will unfold: the latter outcome is probable, which means that the first two will not occur. A continuation of a positive investment outlook hinges on whether bond markets stay relatively calm or if long-term yields climb to new cyclical highs. We anticipate such a turn for the worse at some point, perhaps shortly, underscoring that the investment climate over the balance of the year will be much more challenging than over the last 6-9 months.

Net: our constructive economic outlook indicates that stocks should outperform bonds on a 6-12 month horizon, but both will be at risk once policy rate cut expectations fully unwind. Thus, we are maintaining overweight exposure to cash, which offers attractive yields, limited downside risk, and tactical flexibility against the coming deterioration in the investment backdrop.