Canada And 25% Tariffs: From Bad To Worse – February 3, 2025

A just-published report updated our views on the major global investment issues, including the possible impacts from a peaking in U.S. MAG7 stocks. In addition, Canada (and Mexico) was in the spotlight given that its already vulnerable economy was under the threat of major U.S. tariffs. Indeed, as promised, President Trump went ahead this weekend and hit its northern neighbor with a 25% trade tariff (as well as Mexico, with a smaller tariff on China and threats to further broaden the global trade war).

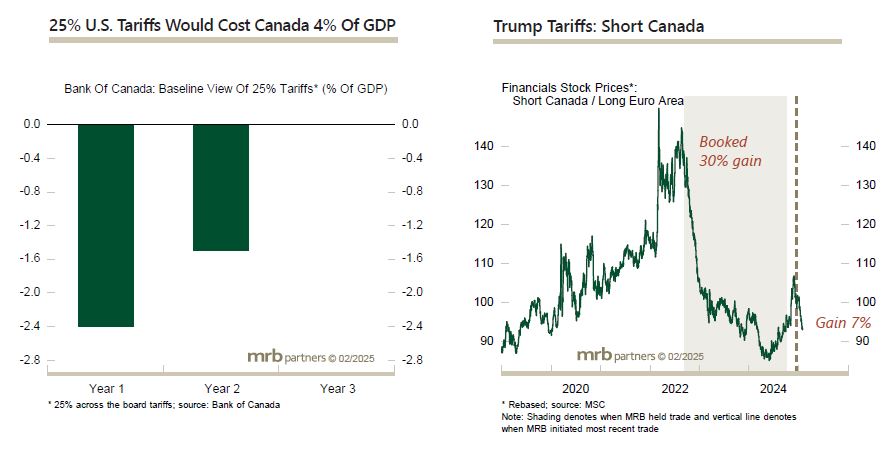

As the report noted, the BoC studied the probable economic impact of such a tariff, and estimated that real GDP would be about 4% lower than otherwise in a 25% tariff scenario, with no recovery thereafter. Thus, it is now likely that the BoC will lower the policy rate substantially further unless the 25% tariff is rolled back (or reduced meaningfully), despite any corresponding near-run boost to inflation.

We have been negative on Canadian economic and FX (and equity) prospects, and even if trade negotiations eventually unwind much of the tariffs, we expect a further widening between BoC and Fed policy expectations. We are still underweight the Canadian dollar and the country’s equity market (within global portfolios). We also have a profitable absolute return position of short Canada versus long Euro Area financial stocks.