The Corporate Earnings Uptrend Goes Global – July 1, 2024

Two reports last week examined global equity market prospects and concluded that conditions outside the U.S. were improving, opening the door to some promising investment opportunities.

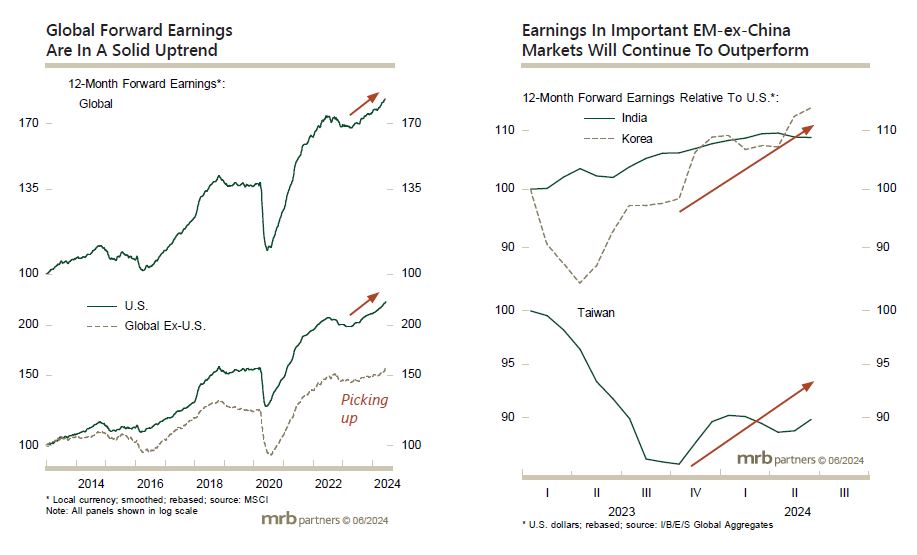

One report updated our view on the major global equity markets, and reiterated our overweight stance on the euro area, EM (especially EM ex-China) and Japanese equities within a global portfolio. While U.S. corporate earnings remain in a solid uptrend, the market already fully reflects a very upbeat outlook and, meanwhile, earnings in some other countries/regions are gradually catching up via the revival in global trade and manufacturing activity. Non-U.S. economic prospects are brightening and broadening after two sluggish years.

The other report examined the corporate earnings outlook for the major EM countries. It concluded that some key markets were already generating superior earnings performance, which has yet to be fully rewarded in equity market performance.

A rotation into select non-U.S. equity markets may not fully blossom until investors’ infatuation with a handful of (mostly) U.S. meg-cap tech stocks is finally exhausted, and a hunt for laggards finally takes hold. The good news is that the macro economic backdrop is conducive to such a rotation, as are momentum and sentiment-type indicators.